Federal Income Tax

Online

Download forms from the IRS Website

Order forms by phone:

1-800-829-3676

Telephone Assistance:

1-800-829-1040

Monday – Friday

7:00 a.m. – 7:00 p.m

In-Person Assistance

All Taxpayer Assistance Centers (TACs) now operate by appointment. Find your nearest. Taxpayer Assistance Center

Electronic Filing Providers

Information about filing your federal income tax electronically.

Refund Status

Check your federal filing and refund status.

Arkansas Income Tax

Online

Download forms from the Arkansas Department of Finance & Administration

Tax Assistance

Helpful information for taxpayers

Electronic Filing Providers

Information about filing your Arkansas state income tax electronically

Refund Status

Check your state filing and refund status

Other State Tax Sites

FindLaw Tax Forms by State.

Tax Provider Information

Tax-Aide from the AARP Foundation

AARP Foundation Tax-Aide offers free tax preparation help to anyone. Find a Tax-Aide location near you

Volunteer Income Tax Assistance and Tax Counseling for the Elderly

The Volunteer Income Tax Assistance (VITA) program offers free tax help to people who generally make $54,000 or less, persons with disabilities and limited English speaking taxpayers who need assistance in preparing their own tax returns.

The Tax Counseling for the Elderly (TCE) program offers free tax help for all taxpayers, particularly those who are 60 years of age and older, specializing in questions about pensions and retirement-related issues unique to seniors.

Federal Legal Resources

The American Bar Association offers various free legal help programs for those who are low-income or in special circumstances.

The United States Department of Justice maintains a free list of pro bono legal service providers for the U.S. and U.S. territories.

State Legal Resources

Arkansas Legal Services is a joint effort between the Center for Arkansas Legal Services and Legal Aid of Arkansas. They assist clients in any county in Arkansas in priority subjects such as family law, consumer issues, bankruptcy, or evictions.

The Arkansas Bar Association has a complete listing of all Arkansas-licensed attorneys. You can find an attorney that fits your legal needs here.

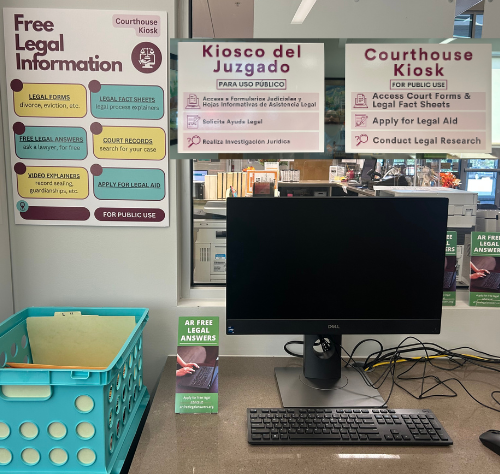

Arkansas Courthouse Kiosk Program

The AR Courthouse Kiosk Program is a collaborative initiative to modernize and expand access to Arkansas’s legal system. The program is a partnership between the Arkansas Access to Justice Foundation, the Court Improvement Program, and the Administrative Office of the Courts. Installing these kiosks has been a long-standing goal of the Court Improvement Program, which focuses on improving outcomes for children and families involved in dependency and neglect cases.

Funding for the kiosks is provided through a federal grant administered by the Administrative Office of the Courts. The Arkansas Access to Justice Foundation—a 501(c)(3) nonprofit dedicated to funding legal aid for low-income Arkansans and strengthening the administration of justice—oversees implementation and ongoing support for the kiosk network.

The kiosk, placed at the Monticello Branch Library, provides the public with immediate access to court forms, legal information, and digital tools that demystify court procedures. Users can also apply for legal aid, review court records, print documents, and watch plain-language video explainers designed to increase legal understanding.

The Arkansas Access to Justice Foundation is a 501(c)(3) nonprofit organization dedicated to funding legal aid for low-income Arkansans and improving the administration of justice. Learn more about the Foundation’s mission at www.arkansasjustice.org or explore the kiosk platform directly at www.ARCourtKiosk.org.